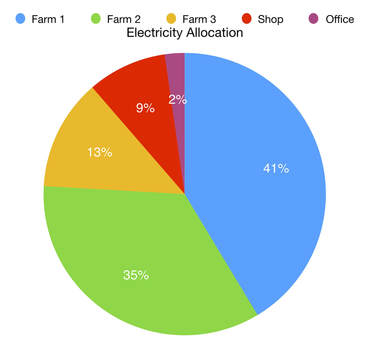

To calculate: Rate of Return on Farm Assets = Net Income / Total Assets

The higher the ratio, the better. The greater the number, more profit per dollar of farm assets.

This will help you evaluate if the farm is using the assets efficiently.

It is important to watch the numbers. Be Smart!

RSS Feed

RSS Feed