|

We have all heard, "You have to spend money to make money." In business the money spent is often referred to as an expense. What is an expense? The IRS describes it as: "Business expenses are the cost of carrying on a trade or business. These expenses are usually deductible if the business operates to make a profit." If you spend money to operate your company it is most likely an expense. Some examples include: advertising expense, rent expense, wage expense, office supplies and interest expense. You want to increase income and reduce expenses.

0 Comments

When I was in elementary school I loved the Great Brain series by John D. Fitzgerald. The books mainly focus on Tom D. Fitzgerald, John's older brother and their childhood in Utah. The other day I noticed "The Great Brain At The Academy" on our book shelf and could not resist the urge to pick it up and read it. I was amazed at the business lesson's taught in the book. Here are ten lessons I learned from the Great Brain.

Now for the fun stuff! Everyone loves income, the more the better. What is income? Income is often referred to as revenues on the financial statements. The official definition from the International Accounting Standards Board (IASB) is:

Income is increases in economic benefits during the accounting period in the form of inflows or enhancements of assets or decreases of liabilities that result in increases in equity other than those relating to contributions from equity participants. Did you get all that? Income for a basic small business is revenue or money received from selling your service or product. If you priced your service or product correctly this will increase your cash in your bank account which should increase your equity in the business. You have to love accounting! One afternoon during a busy tax season the receptionist buzzed me and told me my next appointment was here. I walked into the lobby to greet them and had to hold my breath to keep from laughing. You always hear about the shoe box full of receipts someone brings into the accountant to prepare their taxes. On this day it was not a shoe box but an actual wooden dresser drawer full of receipts. Want to have less stress and a happier life? Good bookkeeping can go a long way toward reducing your anxiety over financial matters. You may not always be pleased with the results, but you will be able to make decisions based on the information, and dresser drawers are difficult to carry in your pocket. Here are five bookkeeping tips to help you get started.

Neville Symington puts forward the idea that a shift from the old routine to a new way of being requires what he calls an act of freedom. This kind of freedom means having a mind of one’s own, acting in faith in oneself and one’s good objects, and taking a chance. We must cut the ties to the old way in order to try something new. Whether we succeed or fail in that one moment, we have succeeded in the big picture because we have invested in real change. (A Headshrinker’s Guide to the Galaxy, 2012) Being successful is difficult and takes courage to change. Many people desire to be financially free but are unwilling to do the work which is required. You must be consistent in the effort put forward and be aware what needs to be done. Start now, do not procrastinate.

Everyone wants equity in a company. Equity is what the shareholders or owners in a business are owed after all liabilities are paid. A simple example is your company sells $1,000 worth of items and you paid $600 for the items. The remaining $400 would eventually end up in the equity account. The legal structure of the business will determine which equity accounts are used. These may include owner's capital, owner's draw for a sole proprietorship or capital stock, common stock, and preferred stock for a corporation.

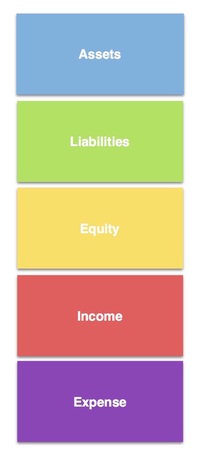

Now for liabilities. In general liabilities in a business are amounts owed to others. These may include: accounts payable (invoices to vendors), wages payable, payroll liabilities (payroll taxes owed to federal and state agencies), sales tax payable, customer advances, bank loans, credit card payable and notes payable. These are just a few examples of liabilities a company may have. If your business owes money to someone else you have a liability. LIABILITIES Let us talk about assets. This is typically the first section on the chart of accounts in an accounting system. What exactly is an asset in regards to a business? Assets are something owned by the company which can be converted into cash. For example cash, office furniture, accounts receivable, inventory and equipment. The more assets the better!

The chart of accounts is divided into sections to help keep your books in order. The basic sections are: assets, liabilities, equity, income and expenses. Each section contains similar accounts which are grouped together to help form the financial statements. These financial statements help you make decisions concerning operating the company.

We all have accounts of some sort. These may be a bank account, investment account, or an account with a vendor or customer. We are all familiar with the term account, but do you actually know the definition? This is straight from the Google research tool:

account;

It is basically where information is stored in order to organize your transactions in your bookkeeping system. |

Archives

May 2023

Categories

All

|

RSS Feed

RSS Feed